Union Pacific–Norfolk Southern combination: Great Connection

24.12.2025

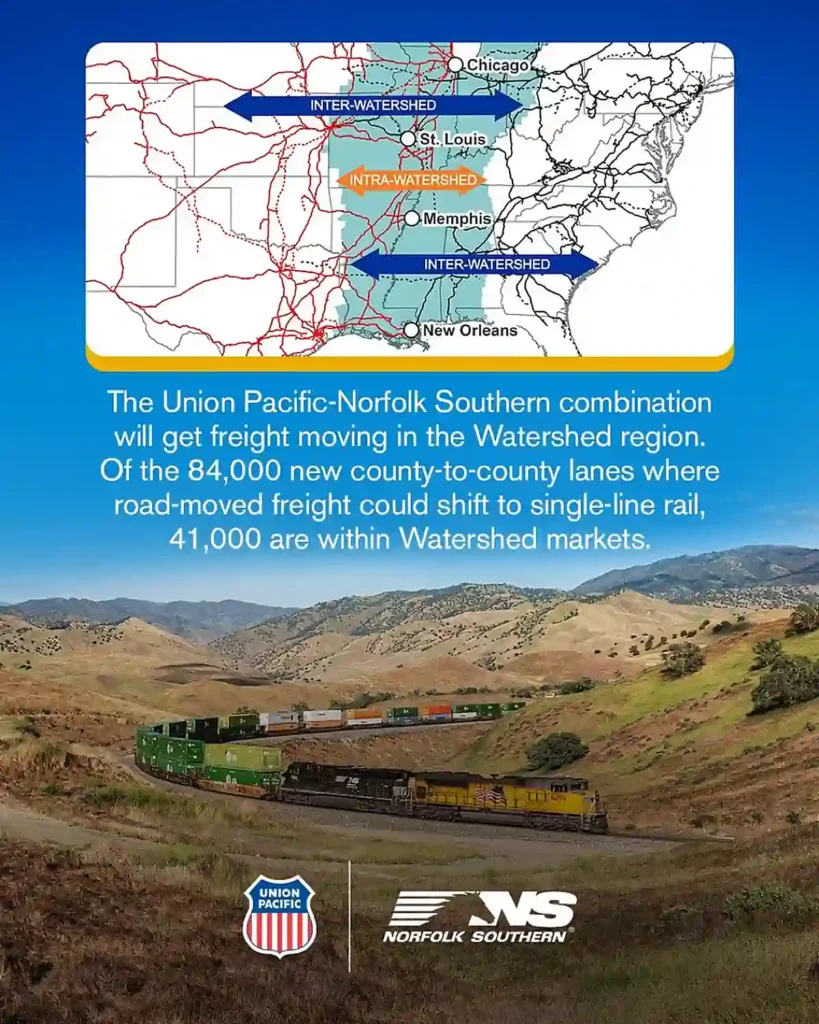

The Union Pacific–Norfolk Southern combination, branded as “The Great Connection”, is presented as a single, integrated freight rail network aimed at strengthening the U.S. supply chain, enhancing competition, and supporting long-term growth for customers, communities, and the national economy.

This is reported by the railway transport news portal Railway Supply.

To explain what they are trying to build, the companies point back to President Abraham Lincoln’s vision for a transcontinental railroad when he signed the Pacific Railway Act in 1862, creating Union Pacific Railroad. In their telling, what followed was a patchwork system, with different carriers moving freight in segments rather than through one connected network.

Don’t miss…Financing of Spain’s freight operators: €44.37 million approved

More than 160 years later, Union Pacific and Norfolk Southern argue that the national rail system is still split by an “artificial barrier” that separates east and west. They say that divide leaves the United States as one of the only developed nations without a connected transcontinental railroad.

What The Great Connection would change?

Union Pacific and Norfolk Southern say an end-to-end combination would create America’s first transcontinental railroad as a single network, transforming the U.S. supply chain and enhancing American competitiveness. They also claim the plan would energize virtually every sector of the economy.

A key operational shift they describe involves lanes that currently rely on interline service. The companies say the combined system would transform 10,000 existing lanes that require time-consuming handoffs between railroads into single-line service intended to be faster and more efficient.

They also estimate 2 million truckloads would move from road to rail, removing trucks from congested, taxpayer-funded roads. Beyond that, the carriers say the combined network would expand service offerings for customers in underserved areas, reach those regions with faster end-to-end service, and provide a unified digital experience with one accountable partner for the entire rail journey. The proposal states it would protect all union jobs.

Transaction details and projected shareholder value

In transaction details, the companies describe an implied total enterprise value of $85 billion for Norfolk Southern. The offer is described as $320 per Norfolk Southern share in stock and cash, a 25% premium to Norfolk Southern’s 30 day-trading volume weighted average price on 7/16/2025, as outlined in a Union Pacific press release.

Union Pacific and Norfolk Southern also cite 60%+ growth in run-rate free cash flow three years post-close. They present $30 billion+ in potential value creation for shareholders, alongside an estimated $2.75 billion annualized synergy opportunity.

The companies say the stock-and-cash structure lets shareholders on both sides participate in upside from growth opportunities and synergies. They add that Union Pacific and Norfolk Southern shareholders are expected to realize more than $30 billion of potential value creation through the expected achievement of approximately $2.75 billion in annualized synergy opportunity.

STB review, approvals, and timeline

Union Pacific and Norfolk Southern argue that creating the Union Pacific Transcontinental Railroad is overwhelmingly in the public interest and would enhance competition—consistent with the test expected to be applied during the review by the Surface Transportation Board’s UP-NS Merger Resources. They say both boards of directors unanimously approved the transaction, and they describe shareholder approval as part of the process.

The companies state they filed their application with the STB on Dec. 19, 2025, a step also summarized by Railway Supply. In that filing, they describe how the combined network would provide safer, faster, and more reliable service and increased competition to a broad range of stakeholders.

They also report that 99% of votes cast by Union Pacific and Norfolk Southern shareholders were in favor of the transaction. The companies are targeting closing the transaction by early 2027.

As presented, the proposed network would link nearly every corner of North America, connecting 50,000 route miles across 43 states, with 10 international interchanges and 100+ ports. The carriers also cite broad support, including 2,000 letters of support from stakeholders, and say backers point to potential benefits such as reduced congestion, expanded rail access, improved reliability, and economic opportunity.

Finally, the companies list the next steps as an STB review and public comment, continued outreach and feedback gathering with customers, employees, and communities, and the development of detailed implementation and service transition plans subject to STB approval.

News on railway transport, industry, and railway technologies from Railway Supply that you might have missed:

Find the latest news of the railway industry in Eastern Europe, the former Soviet Union and the rest of the world on our page on Facebook, Twitter, LinkedIn, read Railway Supply magazine online.Place your ads on webportal and in Railway Supply magazine. Detailed information is in Railway Supply media kit